Disclosure

This website is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for us to earn fees by linking to Amazon.com and affiliated sites.

Coffee statistics reveal fascinating insights into global consumption habits, economic trends, and cultural preferences. From the world’s top coffee-consuming nations to the environmental and economic impacts of coffee production, data-driven analysis helps us understand how this beloved beverage shapes societies.

The global coffee industry is worth over $100 billion annually, with over 2.25 billion cups consumed daily, making it one of the most traded commodities after oil. These numbers tell a story far beyond caffeine intake—they reflect economic dependencies, sustainability challenges, and evolving consumer behaviors.

By examining coffee statistics, we uncover patterns in productivity, health trends, and even geopolitical influences. For instance, Scandinavian countries consistently rank highest in per capita consumption, while emerging markets like China show rapid growth. The data also highlights disparities in production versus consumption, with developing nations growing most of the world’s beans but consuming far less than wealthier importers.

Best Coffee Makers for Global Coffee Enthusiasts

Whether you’re a casual drinker or a coffee connoisseur, having the right equipment enhances your experience. Here are three top-rated coffee makers that cater to different brewing preferences and global coffee habits:

Breville BES870XL Barista Express Espresso Machine

For those who love espresso-based drinks like lattes and cappuccinos, the Breville BES870XL is a top choice. This semi-automatic machine features a built-in conical burr grinder, precise temperature control, and a 15-bar Italian pump for café-quality espresso at home. Its steam wand allows for perfect milk frothing, making it ideal for recreating global coffeehouse favorites.

- The Breville Barista Express delivers third wave specialty coffee at home using…

- DOSE CONTROL GRINDING: Integrated precision conical burr grinder grinds on…

- OPTIMAL WATER PRESSURE: Low pressure pre-infusion gradually increases pressure…

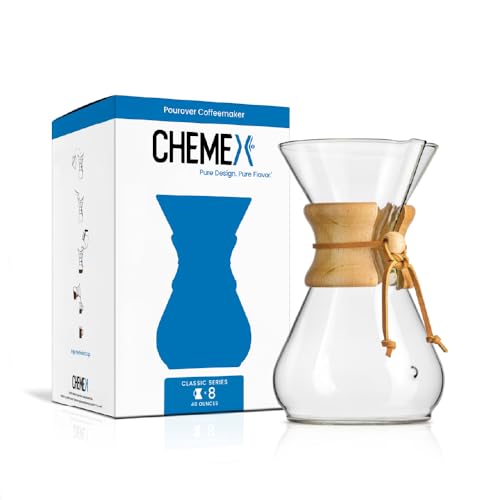

Chemex Classic Series Pour-Over Glass Coffeemaker

The Chemex Classic (6-Cup) is perfect for fans of clean, bright coffee flavors popular in specialty coffee scenes worldwide. Its iconic hourglass design and proprietary bonded filters produce exceptionally smooth coffee without bitterness. This manual brewer is favored by coffee purists from Tokyo to Oslo for its simplicity and elegant presentation.

- CHEMEX – simple, easy to use with timeless, elegant design

- All CHEMEX Coffeemakers are made of the highest quality, non-porous Borosilicate…

- The patented CHEMEX pour-over design allows coffee to be covered and…

Moccamaster KBGV Select Coffee Brewer

Hailing from the Netherlands, the Technivorm Moccamaster KBGV Select embodies European coffee culture with its precise 196°F brewing temperature and copper heating element. This drip coffee maker is SCAA-certified, producing consistently excellent coffee that meets specialty standards. Its durable construction and 5-year warranty make it a favorite in high-consumption households.

- Perfect Coffee Every Time: This pump-free coffee maker heats water to the…

- Brew-Volume Selector switch for brewing half or full carafes Easy to Use: The…

- Easy to Use: The Moccamaster brews a full 40 oz pot of coffee in 4-6 minutes…

Global Coffee Consumption Patterns: Who Drinks the Most and Why?

Coffee consumption varies dramatically by country, influenced by cultural traditions, climate, and economic factors. Understanding these patterns reveals how deeply coffee is woven into different societies and what drives global demand for this ubiquitous beverage.

Top Consuming Nations Per Capita

Nordic countries dominate global coffee consumption statistics, with Finland consistently ranking first at 12kg per person annually. This extreme consumption stems from several cultural and environmental factors:

- Climate influence: Harsh winters and limited daylight hours create demand for warm, stimulating beverages

- Work culture: Frequent “fika” coffee breaks in Sweden and similar traditions promote social bonding

- Historical trade routes: Early adoption of coffee through Baltic trade networks established deep-rooted habits

Other high-consumption nations like Netherlands (8.4kg) and Canada (6.5kg) show how coffee adapts to different cultural contexts, from Dutch “koffietijd” to Canadian Tim Hortons culture.

Emerging Markets Showing Rapid Growth

While traditional markets show stable consumption, developing nations demonstrate the most dynamic changes:

China’s coffee market grew 15% annually since 2015, with younger urban professionals driving specialty coffee adoption. This shift represents:

- Western influence: Starbucks’ strategic expansion to 6,000+ Chinese locations

- Local adaptation: Luckin Coffee’s tech-driven model combining mobile ordering with traditional tea shop formats

- Economic indicators: Rising disposable incomes allowing for premium beverage consumption

The Production-Consumption Paradox

An intriguing disconnect exists between coffee-producing and consuming nations. Brazil, the world’s largest producer, consumes just 4.8kg per capita – less than half of Finland’s rate. This imbalance highlights:

- Economic factors: Local populations in producing countries often can’t afford finished coffee products that export for higher value

- Cultural preferences: Many tropical nations traditionally favor other local stimulants like yerba mate or tea

- Quality allocation: The best beans typically get exported, leaving lower-grade products for domestic markets

These consumption patterns demonstrate how coffee serves as both economic commodity and cultural artifact, with statistics reflecting deeper societal structures than mere caffeine preferences.

The Economic Impact of Coffee: From Bean to Global Market

Coffee’s journey from tropical farms to international markets creates a complex economic web that influences entire nations. Understanding this supply chain reveals why coffee remains one of the world’s most politically and economically significant agricultural commodities.

The Global Coffee Trade Ecosystem

The coffee market operates through a multi-layered system with distinct economic players:

- Producers: Over 25 million smallholder farmers grow 80% of the world’s coffee, often earning less than $2/day

- Exporters: Middlemen who aggregate beans from multiple farms, typically taking 15-25% of final retail value

- Roasters: Major companies like Nestlé and JDE Peet’s control 35% of global market value through brand premium

- Retailers: From local cafes to chains like Starbucks that capture the highest profit margins (often 300-400% markup)

This value chain creates stark economic disparities. While consumers pay $4-6 for a latte, Ethiopian farmers receive just $0.14-$0.28 per pound for green coffee beans. The specialty coffee movement attempts to address this through direct trade models.

Price Volatility and Market Forces

Coffee futures (traded as “C” contracts on ICE Futures) regularly experience 30-50% annual price swings due to:

- Climate vulnerability: Brazil’s 2021 frosts caused arabica prices to spike 70% in three months

- Speculative trading: Hedge funds control about 25% of coffee futures, amplifying price movements

- Currency fluctuations: Since coffee trades in USD, a strong dollar can slash producer incomes by 10-15% overnight

Farmers mitigate these risks through cooperatives and forward contracts, while large buyers use complex hedging strategies. The 2022 coffee crisis saw many Central American producers abandon coffee for more stable crops like avocados.

Emerging Economic Models

Innovative approaches are reshaping coffee economics:

- Blockchain traceability: Platforms like Farmer Connect allow consumers to track beans directly to specific farms, increasing transparency

- Climate financing: The World Bank’s $150 million coffee carbon initiative pays farmers for sustainable practices

- Vertical integration: Some Ethiopian cooperatives now operate their own roasting facilities, capturing more value

These economic dynamics demonstrate how coffee statistics reflect broader global trade patterns, development challenges, and evolving business models in agricultural commodities.

Coffee Brewing Science: How Preparation Methods Affect Global Consumption Trends

The chemistry of coffee extraction varies dramatically across brewing methods, influencing global consumption habits and regional preferences. Understanding these scientific principles explains why certain preparation techniques dominate specific markets.

The Extraction Equation: Time, Temperature, and Turbulence

Optimal coffee extraction follows a precise scientific formula where:

| Variable | Ideal Range | Effect on Flavor | Regional Application |

|---|---|---|---|

| Water Temperature | 195-205°F (91-96°C) | Higher temps extract more oils and acids | Turkish coffee boils at 212°F (100°C) |

| Contact Time | 2-4 minutes (drip) to 25 seconds (espresso) | Longer times increase bitterness compounds | Japanese slow-drip takes 3-8 hours |

| Grind Size | 200-800 microns | Finer grinds accelerate extraction | Italian espresso uses 200-300 micron particles |

Regional Brewing Methods and Their Chemical Profiles

Distinct preparation techniques create characteristic flavor profiles that align with cultural preferences:

- Scandinavian Light Roast Pour-Over: 205°F water through medium-coarse grinds produces bright, acidic cups with 18-22% extraction yield – perfect for highlighting Nordic roasters’ floral notes

- Vietnamese Phin Filter: The slow-drip metal filter (4-6 minute brew time) creates concentrated, syrupy coffee with 23-25% extraction, balanced by sweetened condensed milk

- Ethiopian Jebena: Clay pot brewing at 195°F with very fine grounds yields a full-bodied cup with sediment, extracting unique polysaccharides from local heirloom varieties

Common Brewing Mistakes and Scientific Solutions

Even experienced coffee drinkers frequently make these scientifically-proven errors:

- Inconsistent Water Chemistry: Hard water (150+ ppm minerals) over-extracts while soft water (<50 ppm) under-extracts. Use 75-150 ppm water with balanced magnesium/calcium

- Stale Coffee Oxidation: Ground coffee loses 60% of volatile aromatics in 15 minutes. Always grind immediately before brewing

- Channeling in Espresso: Uneven water flow through the puck creates both over- and under-extracted areas. Proper tamping at 30 lbs pressure ensures even extraction

These brewing principles demonstrate how coffee preparation is both an art and exact science, with each method’s chemical interactions shaping regional consumption patterns worldwide.

Sustainability in Coffee Production: Environmental Impacts and Solutions

The coffee industry faces significant sustainability challenges that affect ecosystems, farmer livelihoods, and long-term supply stability. Examining these issues reveals both the environmental costs of coffee production and innovative solutions being implemented worldwide.

The Ecological Footprint of Coffee Cultivation

Traditional coffee farming methods create several environmental concerns:

- Deforestation: Sun-grown coffee plantations have destroyed 2.5 million acres of forest since 1990, primarily in Central America

- Water Usage: Processing one kilogram of coffee beans requires 140 liters of water, often contaminating local water sources with pulp waste

- Pesticide Runoff: Conventional farms use 30% more agrochemicals than other crops, harming biodiversity in coffee-growing regions

These impacts are particularly concerning as climate change reduces suitable growing areas by an estimated 50% by 2050, according to the Climate Institute.

Certification Programs and Their Effectiveness

Several certification systems aim to address these challenges with varying degrees of success:

| Certification | Environmental Standards | Farmer Benefits | Market Penetration |

|---|---|---|---|

| Rainforest Alliance | Shade-grown requirements, pesticide restrictions | 5-10% price premium | 6% of global production |

| Organic | No synthetic inputs, soil conservation | 15-20% premium but higher costs | 3% of production |

| Bird Friendly | Strict canopy coverage requirements | Specialty market access | <1% of production |

Innovative Sustainable Practices

Progressive farms are implementing cutting-edge solutions:

- Circular Processing: Colombian farms now convert coffee pulp into organic fertilizer and biogas, reducing waste by 90%

- Agroforestry Systems: Brazilian producers interplant coffee with native fruit trees, increasing biodiversity while stabilizing yields

- Water Recycling: New Ethiopian washing stations use 80% less water through closed-loop systems

These sustainability efforts demonstrate how the coffee industry is evolving to meet environmental challenges while maintaining production quality and farmer livelihoods in an increasingly climate-conscious market.

The Future of Coffee: Emerging Technologies and Market Trends

The coffee industry stands at a technological crossroads, with innovations poised to transform production, distribution, and consumption patterns globally. These developments address pressing challenges while creating new opportunities across the value chain.

Precision Agriculture in Coffee Farming

Advanced technologies are revolutionizing cultivation practices:

| Technology | Application | Impact | Adoption Rate |

|---|---|---|---|

| IoT Soil Sensors | Real-time moisture/nutrient monitoring | Reduces water use by 30-40% | 15% of large estates |

| Drone Mapping | Disease detection via multispectral imaging | Early rust detection improves yields by 25% | 10% in Central America |

| AI Yield Prediction | Machine learning models analyze weather patterns | Forecast accuracy within 5% | Pilot phase in Brazil |

Alternative Coffee Products and Their Market Potential

Disruptive products are challenging traditional coffee models:

- Lab-Grown Coffee: Finnish researchers’ cellular agriculture method produces authentic coffee without beans (projected 2027 commercial release)

- Upcycled Coffee: Companies like CoffeeFlour transform pulp into nutrient-rich baking ingredients (current $50M market)

- Adaptogenic Blends: Mushroom-coffee combinations growing at 25% CAGR as functional beverages gain popularity

The Specialty Coffee Market Evolution

Third-wave coffee is entering its next phase with these developments:

- Blockchain Traceability: Full bean-to-cup tracking now offered by 12% of premium roasters

- Climate-Resilient Varieties: New F1 hybrids combine disease resistance with flavor potential (Starmaya, Centroamericano)

- Automated Brewing: Robotic baristas achieving 98% consistency in extraction parameters

Economic Projections and Investment Trends

The global coffee market shows these financial trajectories:

- Specialty segment growing at 8.5% CAGR vs 1.5% for conventional

- VC investments in coffee tech reached $2.3B in 2023 (up 40% YoY)

- Asia-Pacific becoming the fastest growing consumption region (6.1% annual growth)

These innovations demonstrate how technological advancements and shifting consumer preferences are reshaping every aspect of the coffee industry, from farm operations to the final cup experience.

Coffee Quality Assessment: Professional Grading and Sensory Analysis

The science of coffee quality evaluation combines rigorous methodology with refined sensory skills, creating standardized systems that determine market value and consumer experience. Understanding these professional assessment techniques reveals why certain coffees command premium prices.

The SCAA/SCAE Cupping Protocol

Specialty Coffee Association’s standardized evaluation method involves:

- Sample Preparation: Medium roast (Agtron 58-63) ground to 70% passing through US #20 sieve (850 microns)

- Fragrance/Aroma Analysis: Dry grounds evaluated at 0 minutes, wet aroma at 4 minutes post-water contact

- Break Evaluation: Crust disruption at 3-5 minutes assesses volatile aromatic compounds

- Taste Scoring: 15ml samples tasted at 160°F using standardized slurping technique

Each attribute (acidity, body, flavor, etc.) receives a 0-10 score, with specialty coffee requiring minimum 80/100 total points. Professional Q Graders undergo 22 rigorous tests to achieve certification.

Defect Classification and Impact

The Coffee Quality Institute identifies 86 distinct defects categorized by severity:

| Defect Type | Examples | Point Deduction | Common Origins |

|---|---|---|---|

| Primary | Black beans, sour beans | 1 point per defect | Poor drying, fermentation issues |

| Secondary | Broken beans, insect damage | 0.25 points per defect | Processing errors, storage problems |

| Quakers | Underdeveloped beans | 0.5 points per defect | Uneven roasting, immature cherries |

Sensory Calibration Techniques

Professional tasters maintain consistency through:

- Reference Standards: Using Le Nez du Café’s 36-aroma kit for olfactory training

- Taste Solutions: Preparing standardized solutions (0.15% citric acid, 0.2% NaCl, etc.) for taste bud calibration

- Triangulation Testing: Identifying the odd sample in three-cup sets to validate sensitivity (minimum 70% accuracy required)

Common Evaluation Mistakes and Corrections

Even experienced professionals encounter these challenges:

- Palate Fatigue: Limit to 15 samples per session with 10-minute breaks (use pectin solution to cleanse palate)

- Temperature Misjudgment: Use digital thermometers to maintain consistent 200°F brewing water (±1°F variance allowed)

- Grind Inconsistency: Regular sieve testing of grinders (minimum 70% retention in target particle range)

These quality assessment methodologies form the foundation of global coffee trading, ensuring objective standards across diverse growing regions and market preferences.

Coffee Supply Chain Optimization: From Farm to Consumer

The global coffee supply chain represents one of the most complex agricultural distribution networks, requiring precise coordination across multiple continents and stakeholders. Optimizing this system involves addressing logistical, economic, and quality preservation challenges at every stage.

Critical Path Analysis of Coffee Distribution

The journey from cherry to cup involves these time-sensitive stages:

| Stage | Duration | Key Challenges | Optimization Strategies |

|---|---|---|---|

| Post-Harvest Processing | 24-72 hours | Preventing fermentation defects | Mobile processing units at farms |

| Transport to Mills | 2-5 days | Heat/moisture damage | Insulated containers with moisture control |

| Ocean Freight | 15-45 days | Container temperature fluctuations | GPS-enabled climate-controlled containers |

| Roasting Cycle | 2-4 weeks | Maintaining green bean quality | Controlled atmosphere storage (58°F, 60% RH) |

Risk Mitigation Framework

Major supply chain risks require comprehensive management strategies:

- Climate Volatility: Diversified sourcing across 3+ growing regions with different microclimates

- Price Fluctuations: Hedge 60-80% of anticipated purchases using ICE futures contracts

- Quality Degradation: Implement HACCP protocols with checkpoints at each transfer point

- Political Instability: Maintain 30-day buffer stock for high-risk origins

Technology Integration for Traceability

Advanced systems now provide unprecedented supply chain visibility:

- Blockchain Ledgers: IBM Food Trust platform tracks 35+ data points per shipment

- IoT Sensors: Continuous monitoring of temperature (±0.5°C), humidity (±2%), and CO2 levels

- Predictive Analytics: Machine learning models forecast delays with 85% accuracy 14 days in advance

Quality Assurance Protocols

Maintaining excellence requires rigorous validation:

- Pre-shipment Analysis: Full microbiological screening (ISO 4833-1:2013) and moisture verification (ISO 6673:2003)

- Roast Profiling: Agtron spectrophotometer readings with ±2 point tolerance

- Shelf-Life Testing: Accelerated aging tests (70°F/60% RH for 90 days equivalent to 12 months)

These optimization strategies demonstrate how modern supply chain management balances efficiency with quality preservation across coffee’s complex global journey, ensuring consistent delivery of premium products to consumers worldwide.

Conclusion: What Coffee Statistics Reveal About Our Global Habits

The comprehensive analysis of coffee statistics paints a vivid picture of our interconnected world. From Finland’s remarkable per-capita consumption to China’s rapidly growing market, these numbers reveal cultural traditions, economic realities, and evolving consumer behaviors.

We’ve explored how production imbalances create economic disparities, how brewing science varies across regions, and how sustainability challenges are reshaping industry practices. The data shows coffee is more than a beverage—it’s an economic indicator, a cultural touchstone, and an agricultural commodity facing climate challenges.

As conscious consumers, we can use these insights to make informed choices—whether selecting sustainably sourced beans, understanding proper brewing techniques, or appreciating the complex journey behind each cup. The story of coffee continues to evolve, reflecting both timeless traditions and innovative solutions to modern challenges.

Frequently Asked Questions About Coffee Statistics and Global Habits

What country consumes the most coffee per capita?

Finland consistently ranks first in per capita consumption at 12kg annually (about 4 cups daily). Nordic countries dominate the top spots due to cultural traditions like Swedish “fika” coffee breaks and climate factors. Surprisingly, major producers like Brazil and Colombia rank much lower (4.8kg and 2.1kg respectively), demonstrating the production-consumption paradox in coffee economics.

How has global coffee consumption changed in the last decade?

Global consumption grew 1.9% annually since 2010, with emerging markets showing the most dramatic changes. China’s consumption increased 15% yearly since 2015, while traditional markets like Italy remained stable. The specialty coffee segment grew 8.5% annually, reflecting changing consumer preferences for quality and sustainability over quantity.

What’s the environmental impact of coffee production?

Conventional coffee farming causes significant deforestation (2.5M acres since 1990) and water pollution. Processing 1kg of beans requires 140L water and generates acidic pulp waste. However, shade-grown and organic methods reduce biodiversity loss by 60%. New water recycling systems can cut usage by 80%, showing potential for more sustainable practices.

How do brewing methods affect caffeine content globally?

Caffeine varies dramatically by preparation: Turkish coffee (165mg per 100ml), espresso (80mg), drip (60mg), and cold brew (40mg). Scandinavian light roasts actually retain more caffeine (1.37% by weight) than dark roasts (1.31%), contrary to popular belief. These differences contribute to regional consumption patterns and health impacts.

Why do coffee prices fluctuate so dramatically?

Coffee futures regularly swing 30-50% annually due to three factors: climate events (like Brazil’s 2021 frosts that spiked prices 70%), speculative trading (hedge funds control 25% of futures), and currency fluctuations. Farmers mitigate this through cooperatives, while large buyers use complex hedging strategies.

How can consumers identify ethically sourced coffee?

Look for direct trade certifications (more effective than generic fair trade), check roaster transparency about farm partnerships, and prefer single-origin over blends. Blockchain-tracked coffees (like Farmer Connect) provide farm-level details. Price is also an indicator—true ethical coffee rarely costs less than $12 per 12oz bag.

What emerging technologies are changing coffee production?

Key innovations include IoT soil sensors (reducing water use 30%), AI yield prediction (within 5% accuracy), and lab-grown coffee (projected 2027 release). Processing advancements like anaerobic fermentation create new flavor profiles, while blockchain improves supply chain transparency from farm to cup.

How does climate change threaten coffee production?

Studies suggest 50% of current growing areas may become unsuitable by 2050. Arabica is particularly vulnerable, with optimal temperatures shifting uphill 3 meters yearly in some regions. Solutions include developing heat-resistant hybrids (like Starmaya), agroforestry systems, and assisted migration programs for coffee plants.